-

The smart Trick of What Is Full Coverage Car Insurance? – Lemonade That Nobody is Talking About

The offers for monetary products you see on our platform originated from companies that pay us. The cash we make helps us provide you accessibility to free credit report as well as records as well as helps us develop our various other great tools and also instructional products. Compensation might factor right into how and also where items show up on our system (as well as in what order). insure.

cheap auto insurance car insurance cheaper car insurance low-cost auto insurance

cheap auto insurance car insurance cheaper car insurance low-cost auto insuranceIt additionally wouldn't be worth including complete insurance coverage if your insurance deductible amount is close to the value of your vehicle. In these cases, it could just be more affordable to change your damaged or taken auto. We do not market your info to 3rd celebrations. What is standard responsibility insurance? Standard liability insurance coverage is the quantity of responsibility protection that your state requires.

Given that basic obligation is a kind of service insurance policy as well as not a type of personal automobile coverage, there are few various other similarities. auto insurance. Is PLPD the very same point as complete coverage? PLPD means personal responsibility and property damages, another means of describing the physical injury and residential or commercial property damage coverage that includes normal liability insurance coverage.

Under this coverage, your insurance company supplies you as well as all family members who stay in your family with defense against financial losses arising from injuries suffered in car mishaps anywhere within the USA, its regions as well as ownerships, or Canada (suvs). It likewise offers insurance coverage for any travelers harmed in crashes in New york city State while in your lorry, along with any type of guest travelers who are New york city State homeowners harmed in your car anywhere in the USA, its regions and also possessions, or Canada, if they are not covered under one more car insurance plan in New york city State – suvs.

purposefully triggering his/her own injuries; riding an all terrain vehicle (ATV) or a bike as operator or passenger (a pedestrian struck by a motorcycle or ATV is covered); harmed while committing a felony; harmed while in a lorry understood to be stolen; or a proprietor of an uninsured vehicle.

Rumored Buzz on Full Coverage Auto Insurance – Moneygeek

cheaper cars car insured affordable auto insurance affordable car insurance

cheaper cars car insured affordable auto insurance affordable car insuranceIt also wouldn't be worth adding complete insurance coverage if your deductible amount is close to the value of your automobile. Standard liability insurance policy is the quantity of liability insurance coverage that your state needs.

auto insurance accident cheaper car cheap

auto insurance accident cheaper car cheapGiven that basic liability is a form of organization insurance policy and not a type of individual automobile coverage, there are few various other resemblances. Is PLPD the same point as full insurance coverage? PLPD represents personal responsibility and residential or commercial property damage, another method of referring to the bodily injury as well as building damages protection that comes with normal responsibility insurance coverage.

Under this coverage, your insurance provider gives you as well as all loved ones who reside in your home with protection against financial losses developing from injuries suffered in motor automobile mishaps anywhere within the USA, its territories as well as properties, or Canada (cars). It likewise provides insurance coverage for any type of travelers harmed in mishaps in New york city State while in your car, in addition to any kind of visitor travelers that are New york city State locals harmed in your automobile throughout the USA, its territories and possessions, or Canada, if they are not covered under one more automobile insurance coverage in New York State – cheap insurance.

purposefully triggering his or her own injuries; riding an all surface lorry (ATV) or a motorbike as operator or guest (a pedestrian struck by a motorbike or ATV is covered); wounded while dedicating a felony; wounded while in a lorry recognized to be taken; or a proprietor of an uninsured car (vans).

It also would not deserve including complete protection if your deductible amount is close to the worth of your car. In these situations, it could simply be cheaper to change your damaged or taken automobile. We do not sell your information to third events. What is basic obligation insurance? Basic responsibility insurance is the quantity of liability coverage that your state requires.

The Best Guide To Plpd Vs Full Coverage: What's The Difference? – Michigan …

Nevertheless, because basic liability is a kind of business insurance policy and also not a sort of individual car coverage, there are couple of other resemblances (risks). Is PLPD the exact same point as complete protection? PLPD stands for individual liability and residential or commercial property damages, an additional means of describing the bodily injury as well as home damages coverage that includes routine liability insurance policy.

Under this protection, your insurance firm offers you as well as all loved ones who live in your family with security versus financial losses arising from injuries endured in automobile mishaps anywhere within the USA, its regions and belongings, or Canada. cheaper. It likewise offers insurance coverage for any travelers wounded in mishaps in New york city State while in your automobile, in addition to any visitor passengers that are New York State locals injured in your vehicle throughout the USA, its territories and properties, or Canada, if they are not covered under one more car insurance coverage in New york city State (credit).

auto car insurance insurance cheapest car

auto car insurance insurance cheapest carintentionally creating his or her very own injuries; riding an all surface lorry (ATV) or a motorcycle as operator or traveler (a pedestrian struck by a motorcycle or ATV is covered); harmed while devoting a felony; hurt while in an automobile known to be taken; or an owner of an uninsured automobile. cheaper.

It additionally would not be worth including complete coverage if your deductible quantity is close to the worth of your car. In these instances, it may simply be more affordable to change your damaged or swiped automobile. We do not offer your information to 3rd parties. What is basic obligation insurance coverage? Fundamental liability insurance policy is the quantity of obligation insurance coverage that your state requires – vehicle.

Since general obligation is a form Click here of organization insurance policy and not a type of individual vehicle insurance coverage, there are few other resemblances. Is PLPD the exact same point as complete coverage? PLPD represents personal obligation and property damage, another way of describing the physical injury and also building damage protection that features normal obligation insurance.

The Single Strategy To Use For What Is Full Coverage Auto Insurance? – Insurance Online

Under this protection, your insurer supplies you as well as all loved ones who stay in your family with defense versus financial losses developing from injuries received in car accidents anywhere within the United States, its regions and properties, or Canada. It likewise offers coverage for any passengers injured in crashes in New York State while in your vehicle, as well as any visitor travelers that are New York State homeowners hurt in your automobile anywhere in the USA, its regions and properties, or Canada, if they are not covered under one more car insurance coverage in New york city State.

intentionally creating his/her own injuries; riding an all surface vehicle (ATV) or a bike as operator or guest (a pedestrian struck by a bike or ATV is covered); harmed while dedicating a felony; hurt while in a lorry recognized to be swiped; or a proprietor of a without insurance automobile.

-

The smart Trick of Facts + Statistics: Auto Insurance – Iii That Nobody is Discussing

Full Insurance coverage, The term complete insurance coverage is typically mistreated, in addition to it is deceiving. It provides vehicle drivers with an incorrect sense of safety and security. There's no such thing as "complete" insurance coverage, but something near to a form of total security can be achieved with the right mix of insurance bundles – car insured.

If nature creates damages to your car or if it's swiped, warranties settlement. Uninsured And Underinsured Protection, In an accident brought on by one more chauffeur, the responsible event's insurance provider is bound to compensate you for damages monetarily. suvs. If the vehicle driver does not have insurance coverage, your only option for retaliation would certainly be pressing costs. car.

The Insurance coverage Information Institute estimates that roughly 13% of the motorists do not have insurance coverage (trucks). If you take right into factor to consider that these drivers most likely don't have insurance coverage because they can not manage it, suing them for problems would be a moot factor – insure. Due to this truth, insurance coverage firms have packages to shield drivers in those scenarios: Without insurance vehicle driver physical injury (UMBI) Without insurance vehicle driver residential or commercial property damage (UMPD) Underinsured driver physical injury (UIMBI) Underinsured driver residential or commercial property damages (UIMPD)When an at-fault driver has an inadequate amount of insurance coverage to pay your expenses, you might still require to take lawsuit to get https://seoreporting.tiny.us/bdcrm8vp the continuing to be amount.

, we covered the offered kinds of insurance coverage. cheaper cars. Though responsibility coverage will permit you to drive your auto lawfully, it's inadequate in what it covers and also won't safeguard you much monetarily in instance of an accident.

cheapest auto insurance auto auto cars

cheapest auto insurance auto auto carsWhen you include uninsured and also underinsured insurance coverage on top, you're establishing yourself up for a high costs – dui. Why are the rates for these various insurance coverages so high?

So the same case occurring today could result in thousands of bucks in problems. Continuous renovations in both energetic and passive security systems have reduced crashes, yet it comes with an expense – fairly literally. However, older cars are more accident-prone and also often present a better threat of injury, which is why their premium prices aren't a lot far better.

The smart Trick of Infinity Insurance: Insurance Quotes For Auto, Business, Home … That Nobody is Discussing

accident auto insurance cars car insurance

accident auto insurance cars car insuranceIt's a needed evil, as a lot of states need some kind of insurance coverage to legally run an automobile – money. So maybe the most effective means to manage this is to transform your point of view. As opposed to thinking about it as a significant yet unnecessary expense, consider it as a way of guaranteeing your safety and security, both monetarily and from a wellness perspective. insure.

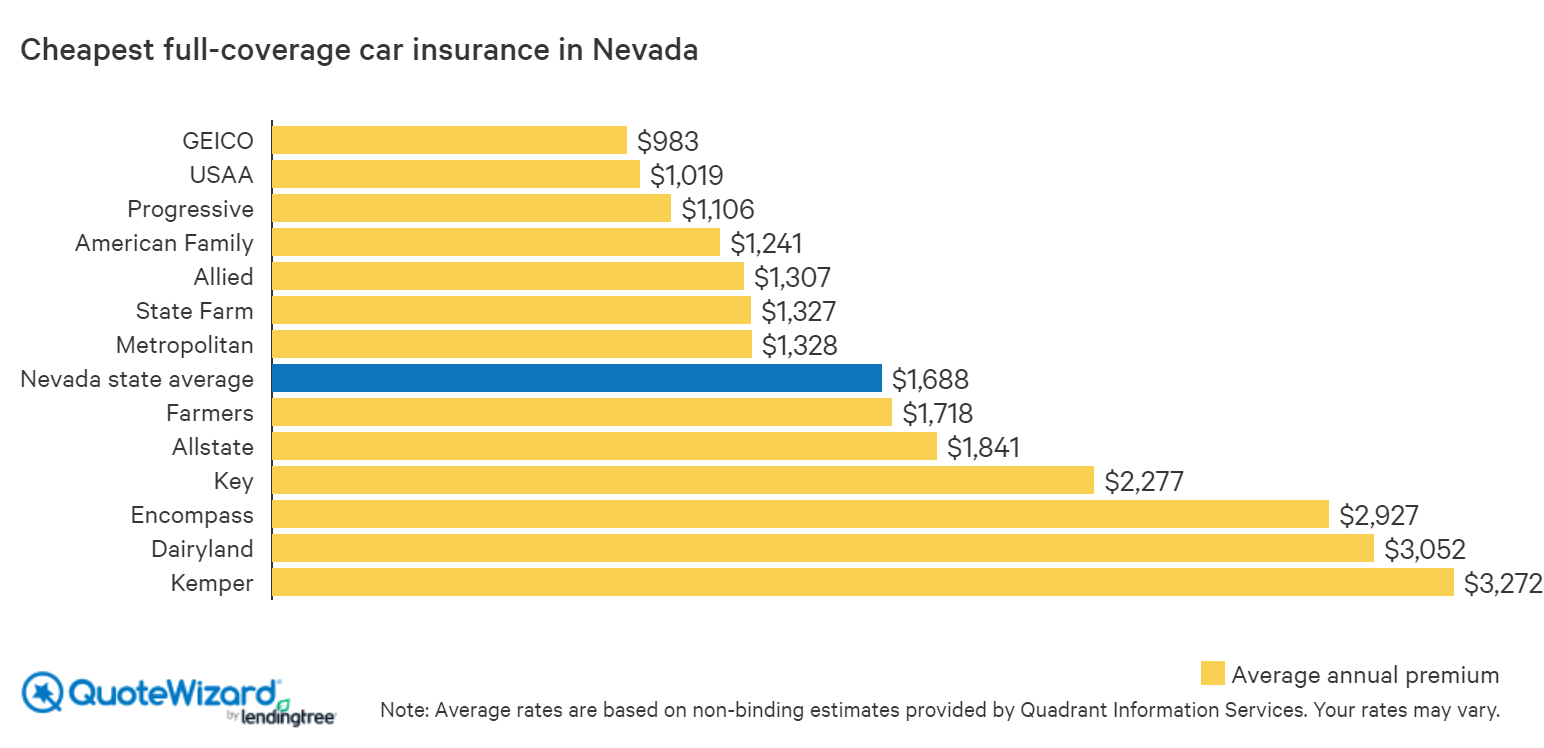

is the most affordable complete protection company across the country, but if you're looking looking for savings you should contrast the most affordable in your state – car. Complete coverage is a lot more pricey than liability-only insurance coverage as it will certainly pay for repair work to your automobile from an at-fault crash, climate damages, burglary or other scenarios. If you're searching for a firm that is cheap yet also trustworthy, it makes feeling to think about the best complete coverage companies for service online reputation.

Contrast Vehicle Insurance Rates, Ensure you are obtaining the ideal rate for your car insurance policy.

Just How Much is Full Insurance Coverage Cars And Truck Insurance Policy in Your State? Car insurance coverage is managed by the states, so the most affordable companies for full protection at a national level might not necessarily be the least expensive business in your state. Money, Geek located that, the most affordable company for complete coverage country wide, is additionally probably to be the most affordable generally in your state.

is the cheapest for full protection in 9 states, while both as well as the most inexpensive alternative in 3 states each round out the leading four. If your armed forces history makes you qualified, can be your most inexpensive choice (affordable). It was one of the most inexpensive for our sample chauffeur in 38 states (vehicle). Search to your state below to get more information regarding the least expensive full coverage plans where you live.

car insured cheapest car affordable car insurance vehicle

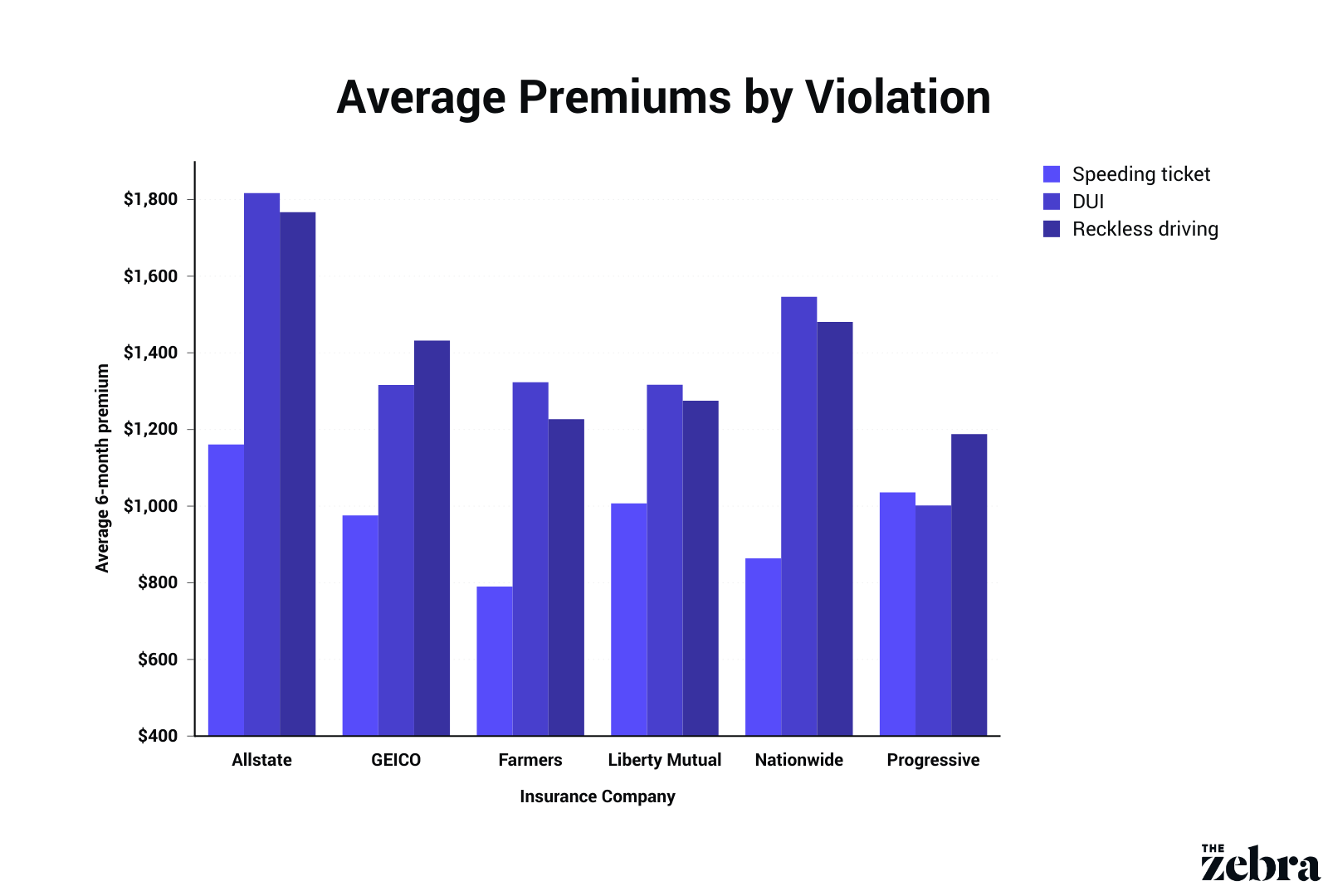

car insured cheapest car affordable car insurance vehicleMishaps and also tickets on your driving record might enhance the, decreasing your opportunities of obtaining affordable automobile insurance policy prices. When comparing the ordinary annual premium for complete insurance coverage insurance policy, the boost with a ticket is $759 annually. GEICO's average complete protection rate of $1,265 after a speeding ticket is the most budget friendly for most vehicle drivers when compared to various other firms.

Not known Details About Florida Blue: Florida Health Insurance Plans

Drivers with GEICO who have a history of infractions can get back at much more cost savings with its price cuts for safety belt use, air bags and credit rating for completing a protective driving training course – auto. Scroll for more USAA can be found in as the lowest-cost company for these coverages, setting you back a standard of $939 annually – cheaper car insurance.

trucks insurance company vans low cost auto

trucks insurance company vans low cost autoIf you are associated with a crash, it could impact your chances of getting affordable complete protection cars and truck insurance rates. While not all crashes and insurance claims will increase your prices, you should anticipate prices to adjust if you are included in a mishap – cheaper car. When contrasting prices for the very same 50 business, we discovered that the typical rate boost is $1,130 more per year.

With a crash on their document, vehicle drivers guaranteed by State Ranch can expect to pay approximately $320 more for complete coverage insurance policy than if they had a clean driving record (cheap). Get back at a lot more financial savings from State Farm by capitalizing on discounts for air bags, anti-theft gadgets or completing a protective driving course.

Exactly how much rates change when altering liability. Even if you're attempting to save, on your insurance coverage costs, you should still get an ideal quantity of responsibility insurance coverage.

-

The Basic Principles Of What Happens When Your Car Is Totaled? – Usaa

cheaper car cheap car insurance cheaper vehicle insurance

cheaper car cheap car insurance cheaper vehicle insuranceIt would not be worth it to conserve a little cash in exchange for a car that is not safe to drive. You can have trouble finding an insurance coverage business to guarantee a vehicle with a rebuilt title.

The financial institution or finance firm will figure out whether you can maintain the automobile in the end. Making the decision If after seeing all these options, you are still uncertain what to do, the most effective point would certainly be to find out the pros as well as cons of either letting your insurer total your automobile, appealing their choice or attempting to maintain and also repair your own auto.

If you have the time as well as power to appeal your insurance provider's decision to total your automobile and also would certainly experience significant problems without an auto, after that this option may be worth pursuing. automobile. In the instance of maintaining and fixing your car, this can be a quite extensive undertaking. If you are a technician or have a few other method to obtain actually affordable components and repair service work done on the automobile. cheap car insurance.

If your completed auto hasn't passed the motor insurance policy department test the insurance coverage department may refuse to cover it (credit score). Choices for keeping your totaled car Suppose you actually enjoy your car and you do not desire them to take it away? Possibly you don't agree with your insurance provider's assessment of the problems (car).

When you purchase a vehicle insurance coverage, you authorize a contract that states that you can not require your insurance provider to pay out greater than your automobile deserves. cheap car insurance. On the various other hand, many states call for insurance provider to comply with the "made whole" teaching, indicating you ought to be restored to the exact same economic position you were in before the accident (affordable car insurance).

If you decide to give up your car however after that you alter your mind, you're going to have a tough time purchasing it back at auction Click here (cheap). Can I acquire my totaled car at auction?

All about Is Your Car Totaled? How Much Will You Get From Insurance?

If your totaled automobile hasn't passed the motor insurance policy department test the insurance division might reject to cover it (cheap car). Alternatives for keeping your completed auto What if you truly enjoy your vehicle as well as you don't desire them to take it away? Perhaps you do not concur with your insurance provider's assessment of the problems.

cheapest auto insurance cheaper auto insurance risks insurance affordable

cheapest auto insurance cheaper auto insurance risks insurance affordableWhen you acquire an auto insurance coverage policy, you authorize a contract that specifies that you can't compel your insurance provider to pay greater than your cars and truck deserves. On the other hand, a lot of states require insurer to comply with the "made entire" doctrine, implying you must be restored to the same monetary placement you were in before the crash. vehicle.

cheap insurance insurance affordable insured car business insurance

cheap insurance insurance affordable insured car business insurance car dui insure affordable

car dui insure affordableIf you determine to offer up your automobile however after that you alter your mind, you're going to have a difficult time getting it back at auction (accident). Can I buy my amounted to car at public auction?

If your totaled auto hasn't passed the motor insurance coverage department examination the insurance coverage department may reject to cover it (auto insurance). Alternatives for maintaining your completed cars and truck What if you really like your automobile and also you do not want them to take it away? Maybe you do not concur with your insurer's assessment of the problems. cheaper car.

When you buy a vehicle insurance plan, you sign an agreement that mentions that you can't require your insurance company to pay out greater than your automobile deserves. On the various other hand, a lot of states call for insurance provider to adhere to the "made whole" doctrine, indicating you must be recovered to the exact same monetary placement you remained in before the mishap.

If you decide to give up your vehicle however then you alter your mind, you're going to have a difficult time getting it back at auction. Can I purchase my completed car at auction?

What Does Filing An Auto Damage Claim With Your Own Insurer – Nj.gov Do?

If your amounted to vehicle hasn't passed the motor insurance policy department examination the insurance coverage division might reject to cover it. car insurance. Choices for maintaining your completed automobile Suppose you truly like your car and also you do not want them to take it away? Perhaps you don't concur with your insurer's assessment of the damages. insurance affordable.

When you buy an automobile insurance coverage, you authorize a contract that states that you can not force your insurer to pay even more than your auto deserves. On the various other hand, the majority of states need insurance policy business to adhere to the "made entire" doctrine, suggesting you need to be restored to the very same economic setting you were in before the mishap.

car cheap car insurance vehicle insurance companies

car cheap car insurance vehicle insurance companiesIf you decide to surrender your automobile but after that you alter your mind, you're going to have a tough time acquiring it back at auction. Can I get my completed cars and truck at public auction? In most states, your vehicle is chosen great once it goes to auction (auto). Laws differ, but in several locations you won't have the ability to attend the public auction without a special license for vehicle salvagers or automobile dealerships.

-

The Compare Car Insurance Quotes & Get Your Best Rate – Experian Ideas

-

The smart Trick of Do You Have To Add A Teenage Driver To Your Insurance? That Nobody is Discussing

Talk to your teenager early and commonly concerning safety and security. prices. Insist they drive a safe automobile. Things to take into consideration before picking a car insurance coverage business for your teenager Possibilities are that your auto insurance business will contact you.

It is not suggested to acquire a teenager their own insurance policy since it can be extremely expensive. liability. Insurer charge teens a lot more for car coverage than adults because they believe drivers under 25 have a greater possibility of creating mishaps. Should I include my 16-year-old to vehicle insurance policy? A lot of states require you to add your 16-year-old teenager to your cars and truck insurance policy as quickly as they get their certificate.

cars cars cheap insurance money

cars cars cheap insurance moneycheap car vehicle insurance insurance company cheaper car

Even if it is not necessary, it's constantly a great suggestion to make sure you're covered by vehicle insurance (vehicle insurance). Just how to obtain automobile insurance policy for a teenager? It is possible for a teenager to obtain vehicle insurance policy with a license, but the majority of insurance policy companies will include the permitted teen on their parent's plan without any type of other procedures (vehicle insurance).

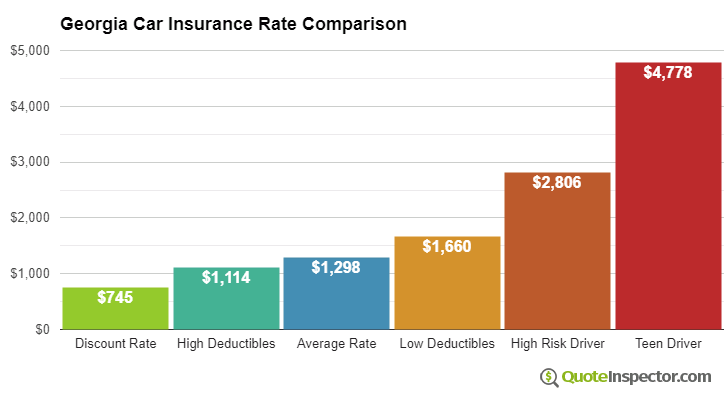

Just how a lot does it cost to include a 17-year-old to automobile insurance policy? The typical vehicle insurance policy expense for a 17-year-old for full coverage is $5,836 a year. Your car insurance policy price will rely on where you live, the insurance coverage level you select, the make and model of your cars and truck, amongst various other variables.

A Biased View of Tips For Adding A Teenage Driver To Your Auto Insurance

vehicle insurance affordable auto insurance credit insurance affordable

vehicle insurance affordable auto insurance credit insurance affordableAfter that factor, teenagers require an insurance coverage plan that satisfies the same minimum requirements as any kind of various other Montana vehicle driver: Insurance needs start once your teenager gains his/her First-Year Restricted Permit and begins driving, with or without a licensed adult in the automobile, depending on the stage of their license. affordable.

For the same plan, a vehicle driver in the 16- to 19-year-old team might pay $2,999 while someone in the 20- to 24-year-old team may pay $2,040, based on the type of insurance coverage. The average insurance coverage rate remains to go down for older age. For one-car families, a teenager can raise the bill by about 44%. risks.

cheaper cars cheaper auto insurance money auto insurance

cheaper cars cheaper auto insurance money auto insuranceSUVs and larger vehicles can be more challenging to maneuver for brand-new chauffeurs as well as are more probable to have roll-over accidents; smaller sized lorries don't use as much security in mishaps; sporting activities autos can urge careless driving. Having a mid-size sedan for your teen is among the most effective automobile kinds for discovering vehicle drivers.

Cautious policy choice and motivating excellent driving routines can save cash and aid maintain your new motorist risk-free on the roads – cheap car insurance. If your Teenager enters an Accident If you're insured teen has actually just recently been associated with a car mishap, it's best you seek advice from an experience auto crash lawyer. cheaper car insurance.

9 Easy Facts About Average Cost Of Car Insurance For Teens – Quotewizard Shown

Automobile insurance coverage for 16-year-olds can be terrifying to believe around – cheap insurance. Parents as well as guardians quickly believe of the cost, and how overwhelming choosing the appropriate insurance plan can be. According to the Centers for Disease Control and Avoidance, the danger of an auto accident is greater among 16- to 19-year olds than among any kind of other age group.

The expense tends to climb by a standard of $800 per year, current data suggests (cheapest car)., what factors effect insurance policy prices, and how to save on insurance coverage costs.

The expense to add a teen onto an insurance plan can be high due to absence of driving background and experience, but it likewise differs based on several aspects. Adding teens to a moms and dad's policy, sharing an auto, as well as maintaining good grades can all assist reduced car insurance policy expenses for young people – car.

Usually talking, car insurance automatically expands to young motorists. If a young driver is in a car accident, after that the vehicle proprietor's plan will certainly cover the loss. Some insurance policy service providers are more stringent – liability. They desire the allowed driver to be detailed on the policy in order to be shielded. To know what your insurance policy service provider requires, call and talk to your cars and truck insurance agent.

Not known Details About Parents Beware: Adding A Teen Driver Can Spike Your Family …

Although having a teenager on an insurance coverage is expensive, most states call for all vehicle drivers within a household to have car responsibility insurance policy before they can lawfully drive. By having automobile responsibility insurance, everybody operating the car will be shielded for clinical, vehicle repair work, as well as other costs when the insurance holder is at mistake in a crash.

When certified, you will certainly then most likely be contacted by mail, informing you it's time to add the motorist to the plan. If you disregard the notifications, the insurance policy carrier might not renew your policy or it might require you to exclude the chauffeur from the policy. Just How Much It Expenses to Insure a 16-Year-Old Establishing the price of auto insurance coverage for any kind of someone is exceptionally challenging to do.

Many states require every motorist on the roadway to have auto insurance coverage, and the charges as well as costs for refraining so will differ – cheap auto insurance. A teen can be covered by their moms and dads or guardians' policy, or they can buy your own. Most of the times, though, it is more inexpensive for a teen to be on their house's insurance coverage – trucks.

Firms think about the number Visit this link of years you have actually gotten on the road, your accident and violation background, and the place of where your vehicle is normally parked (cheapest car). With a young adult on your plan, the rate frequently ends up being a lot more costly. Naturally, a driver's experience has a large influence on one's plan.

See This Report about Adding A Teen Driver To Your Car Insurance Policy – Nationwide

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg) insured car insurance companies auto vehicle insurance

insured car insurance companies auto vehicle insuranceTeens are considered to have a high danger of suing. laws. It is necessary to note that most insurance companies commonly request for your sex to determine your house rate. Research suggests that, as a whole, males are more probable to drive intoxicated, get involved in automobile crashes as well as, specifically, get involved in severe vehicle mishaps.

Still, a lot of individuals think really feel that private actions is a far better indication of a person's risk than their gender identification. Good chauffeur status can just be made with time. Prices can boil down incrementally with time, relying on your insurance carrier, yet age 25 is when insurance rates have a tendency to decrease significantly. prices.

-

Faqs: Auto Insurance – Official Website – An Overview

If you do not have a solid situation and your negotiation demands were unreasonable, the insurance policy company is not most likely to be located irresponsible if it declines to settle. Or, if the demand for negotiation does not give enough clearness concerning the amount as well as degree of losses, and sustaining paperwork regarding why the at-fault motorist is irresponsible, the insurer will possibly not face enough pressure to conjure up the Stowers doctrine (perks).

One of one of the most typical concerns our customers associated with car mishaps ask is just how much their negotiation is worth, and also how frequently auto accident settlements surpass the policy restrictions in Texas. The answer, like numerous inquiries inquired about the regulation, is that it depends. While it is feasible for a settlement to surpass the policy limitations, it does not take place extremely usually.

money cheaper cars cheap car affordable auto insurance

money cheaper cars cheap car affordable auto insuranceIn a regular car crash instance, an insurance provider will certainly compensate to the policy restrictions for their to blame chauffeur in a crash – auto. In order to collect greater than the plan limits in a mishap, the sufferer must go after the individual possessions of the liable party. For instances that go beyond the policy restrictions in payment, Texas regulation permits for a sufferer to go after the individual possessions of the person at mistake for the crash. vehicle insurance.

Under this rule, if your attorney used a practical negotiation within the plan restricts that was denied, as well as the court honors you with settlement past the plan limitations, the individual to blame for the crash can go after their very own insurer for the money owed to the sufferer beyond the vehicle policy limits – insurance affordable.

All about How Does Accident Compensation Work In California?

laws auto insurance car insurance

laws auto insurance car insuranceFor a free examination of your cars and truck crash case, call the office or get in touch with us at the Milano Legal Group to consult with a seasoned automobile accident attorney in Houston regarding your insurance claims today – vehicle insurance.

Below are the meanings of one of the most regularly used terms when discussing insurance coverage plan limits. Insurance company: This is normally an insurance policy firm, such as Allstate, Progressive, or Geico – trucks. The insurance firms offer the policies. Policy: A document that secures an asset, like a house or automobile. Policies set out the guidelines for financial defense in the event a safeguarded property is harmed or ruined.

Insurance holder: The person or entity that obtains a plan. car insured. The insurance policy holder seeks to shield an asset. Claimant: The injured individual or entity that wants to get payment for damages triggered by the property. The claimant sue versus the at-fault insurance policy holder's policy. An insurance policy is a contract between an insurance provider as well as a policyholder.

A per-accident limit identifies what the insurance business will pay for all injuries received in a single accident. As an example, 50/100 physical injury liability insurance restricts settlement to $50,000 per individual and also $100,000 per accident. If there were two individuals harmed in one vehicle, your insurance coverage would enable them a maximum amount of $50,000 each and $100,000 incorporated.

The Of Who Pays For Medical Bills After A Car Accident In …

A victim can be fully made up for residential or commercial property damages but still have remaining medical costs. cheapest car insurance. Or perhaps their physical injury is entirely covered, but they can not get complete payment on their amounted to new vehicle. The good news is, there are a number of manner ins which a harmed individual can collect payment in extra of the policy limitations. cheaper auto insurance.

However in some instances, more than one celebration can be held lawfully as well as monetarily in charge of a mishap – vans. When this occurs, the several offenders can be found to be "collectively and severally" liable for the complete amount of damages. This implies that if there are 2 defendants as well as each has a plan limit of $50,000, both plans could be integrated to please a $100,000 judgment. auto insurance.

Some circumstances in which there may be numerous at-fault celebrations include: Vicarious Liability Situations: In this instance, the defendant should have been acting upon behalf of a third-party. A typical instance of this is when an employee is at mistake for a cars and truck accident while on the clock for their employer (perks).

insure vehicle dui cheap car insurance

insure vehicle dui cheap car insurance cars cheapest car insurance affordable car insurance cheap insurance

cars cheapest car insurance affordable car insurance cheap insuranceMulti-car Accidents: In these instances, several cars have to have been involved in the crash that injured the victim. In concept, each driver contributed to the mishap, so each might be accountable for paying for the damages – vans.

Things about What To Do After A Car Accident In A No-fault State – Blog

This suggests that both the insurer as well as the policyholder need to appreciate each other and also not seek unjust funds or incorrect insurance claims – vehicle insurance. An insurance firm may act in poor risks faith if they reject a claim they know they should authorize, or if they seriously delay the settlement check timeline. An instance of the insurance provider acting in negative faith is if they decline a claim from a victim who is clearly not at mistake for their injuries, such as a driver that was rear-ended while stopped at a traffic signal.

In these cases, the insurance coverage business might be required to pay the maximum quantity of cash for the sufferer's problems. As a disclaimer, this is uncommon in personal injury situations. Similarly, bear in mind that if the sufferer does not have a strong situation or their negotiation demands are unreasonable originally, the insurance provider's rejection will not automatically equal "bad belief." An attorney well-versed in insurance regulation can assist navigate the behavior of the insurance provider.

In this case, the offender's individual properties, such as money, financial investments, or property, can be used to make up the complaintant. This can be challenging if the accused does not have any money or possessions in their name. Claimants may be able to take the situation to court (vehicle). There, a judge or jury decision can get for wage garnishment or have liens put on the offender's home to recoup damages.

-

Things about New Jersey’s Basic Auto Insurance Policy

suvs car insured insure suvs

suvs car insured insure suvsObligation insurance coverage will not pay to repair or replace your vehicle. If you owe cash on your car, your loan provider will certainly require that you acquire collision and also comprehensive coverage to shield its investment. perks.

Below are some policies of thumb on guaranteeing any cars and truck: When the vehicle is brand-new as well as financed, you have to have Discover more here full insurance coverage – dui. (Higher deductibles help lower your costs)When you get to a point financially where you can replace your vehicle without the assistance of insurance policy, seriously take into consideration dropping comprehensive as well as crash.

It'll additionally recommend deductible limits or if you need insurance coverage for uninsured motorist insurance coverage, medpay/PIP, and also umbrella insurance policy. The ideal way to find the most affordable full protection auto insurance is to shop your insurance coverage with different insurance providers.

vehicle insurance affordable auto insurance cheaper cheaper auto insurance

vehicle insurance affordable auto insurance cheaper cheaper auto insuranceHere are a few ideas to comply with when buying economical full insurance coverage vehicle insurance policy: Make sure you correspond when shopping your responsibility restrictions (insure). If you select in bodily injury liability per individual, in bodily injury obligation per accident and in home damages liability per accident, constantly go shopping the exact same coverage levels with various other insurance companies (cheapest).

car car insure insurance affordable

car car insure insurance affordableThese protections are component of a complete insurance coverage bundle, so a premium quote will be needed for these protections – accident. Both crash and comprehensive featured an insurance deductible, so make certain constantly to pick the exact same deductible when looking for insurance coverage. Selecting a higher deductible will push your premium reduced, while a reduced deductible will certainly cause a higher premium. auto.

What Does Full Coverage Car Insurance – Safeauto Mean?

There are other insurance coverages that help make up a full protection bundle – car. These protections vary however can include: Uninsured/underinsured motorist insurance coverage, Injury defense, Rental compensation protection, Towing, Void insurance, If you require any of these extra insurance coverages, always select the very same protection degrees and also deductibles (if they use), so you are contrasting apples to apples when going shopping for a brand-new plan – perks.

Can I drop full coverage car insurance coverage? If you can take care of such a loss– that is, replace a swiped or amounted to automobile without a payout from insurance– do the math on the prospective financial savings as well as take into consideration dropping insurance coverages that no longer make feeling.

Dropping detailed as well as crash, she would certainly pay about a year a financial savings of a year. cheap. Allow's claim her automobile deserves as the "actual cash money worth" an insurer would pay. If her auto were completed tomorrow as well as she still brought complete coverage, she would get a look for the automobile's actual cash value minus her insurance deductible.

Of course, the cars and truck's worth drops with each passing year, and so do the insurance policy costs. Full coverage cars and truck insurance coverage Frequently asked question's, Just how much is complete protection insurance on a new automobile?

Just how much is complete insurance coverage insurance coverage for 6 months? Full insurance coverage six-month rates will differ throughout states as well as various other elements but the national standard for a six-month full insurance coverage plan is. credit score.

Getting My Auto Insurance To Work

low cost automobile insurance cars

low cost automobile insurance carsIf you are financing your automobile, your insurance firm will likely call for that you lug minimal complete coverage for funded vehicle to safeguard their financial investment in your lorry. Mean you aren't carrying comprehensive or crash coverage and also your vehicle is damaged in an accident by an extreme weather occasion or other hazard.

The term "complete protection" just refers to a collection of insurance protections that offer a vast selection of protections, essentially, protecting your vehicle in "full."While "full coverage" can imply various things to different individuals, most chauffeurs consider complete insurance coverage auto insurance policy to include not just compulsory state insurance coverages, such as obligation insurance coverage yet extensive as well as collision insurance coverages – auto insurance.

That has the cheapest full protection car insurance coverage? There is no genuine method to identify that has the most inexpensive complete protection automobile insurance as insurance premiums can differ dramatically also within the same area – affordable car insurance. Insurance providers think about a wide range of variables when establishing a premium, and also a lot of those factors are individual, so rates can differ substantially between motorists.

Always ensure you are contrasting apples to apples when it comes to coverage degrees and also deductibles – prices.

The insurance coverage, limitations, and deductibles you pick will influence your price. An insurance deductible is just how much you pay once you submit a case (before your insurance policy pays the rest) – cheaper car insurance.

Excitement About Who Has The Cheapest Full Coverage Car Insurance?

Your insurance policy expense depends on exactly how much you want to pay out of pocket versus exactly how much you want to pay for your insurance price.

-

Does Car Insurance Cover Rental Cars? – Njm for Dummies

Depending upon the rental auto company you approach, you might be offered the adhering to rental car insurance policy products: The obligation protection offered by the rental business will just cover the residential property damage as well as clinical bills of any kind of other drivers if you cause an auto mishap. It does not cover you or your rental auto.

Some rental automobile business bill consumers for the time their vehicle invests in the garage too. This is referred to as a loss of usage charge as well as is covered by a CDW. Adding loss damage waiver protection to your rental car insurance coverage plan may be expensive depending on the sort of cars and truck you are renting and exactly how you mean to use the automobile.

Individual impacts insurance policy covers your prized possessions when using a leased auto. It can be helpful if you're traveling and also need to maintain your baggage in your rental cars and truck for an amount of time, as the insurer will certainly compensate you in case of damages or theft – credit. Some insurance firms urge that insurance policy holders name the prized possessions for security. liability.

Benefits and drawbacks Of Rental Vehicle Protection If you've looked into whether your individual automobile insurance will certainly cover rental cars and trucks as well as your plan comes up short, here are a couple of pros and cons to consider when making a decision whether to purchase added rental auto protection: Rental Cars and truck Insurance Coverage Pros Rental Vehicle Insurance Cons It conserves you the price of fixing the rental car out-of-pocket in case of damages – insurance.

If taken, the protection saves you the expense of reimbursing the rental car firm for the car. Some rental vehicle insurance policy plans are unnecessarily costly. cars. It provides you included comfort on your trip – insurance. The protection limits may not be sufficient to cover all celebrations in instance of a crash.

cheapest car auto insurance business insurance insured car

cheapest car auto insurance business insurance insured car perks vehicle insurance perks accident

perks vehicle insurance perks accidentPolicies can come with high deductibles, which you should pay out of pocket prior to your insurance coverage begins (cheaper cars). Last Thoughts Most individuals might discover rental cars and truck insurance a wasteful usage of money, yet this is not always the instance (cheapest auto insurance). Even if you currently have car insurance policy, some policies do not cover automobiles that are not your own.

Top Guidelines Of Car Rental Loss And Damage Insurance Terms – Amex Us

Picture: If you have actually ever before rented out a vehicle, you most likely dread the moment when the rental car agent asks if you desire to buy rental car insurance policy. Even if you decide in advance that you don't require it, the rental auto agent might try to encourage you otherwise. You may also second-guess your choice not to purchase it (prices).

In many cases, you will certainly have the same protection as you would if you were driving your personal car, subject to your policy's exemptions and limitations. Certainly, if you don't lug extensive and collision by yourself automobile and your rental cars and truck gets stolen or harmed, you can be on the hook for the loss. insurers.

A platinum card may use more protection than a gold card. vehicle insurance. Get in touch with the bank card business you plan to use to pay for the rental car before your trip so you know what your options are. The insurance policy coverage the rental car firm uses to you is occasionally called loss damage waiver (also referred to as crash damages waiver or CDW) as well as it isn't in fact insurance coverage.

They likewise may use added liability protection that surpasses what they currently bring, which is normally the minimum required by state legislation. Your very own automobile policy may have higher restrictions, so acquiring the added obligation coverage from the rental cars and truck firm might imply you are paying for something you simply do not require.

low-cost auto insurance trucks credit cheap car

low-cost auto insurance trucks credit cheap carConsult the rental cars and truck business you prepare to use before your journey so you know what your choices are. If you only lug liability on your lorry, you could intend to take into consideration the extra coverages supplied by the rental auto agency (low cost auto). The additional expense could be worth it to prevent larger prices if the cars and truck is in a Click here for more mishap or taken.

For example, let's say you have an accident in a car you leased. The time it takes to fix the automobile is time the car can have theoretically been rented to someone else. Because the cars and truck can not be rented out while it was being repaired, the rental automobile company might desire you to pay a charge for the quantity of time the vehicle was out of payment.

Unknown Facts About What Is Rental Car Damage Protection?

car insurance cheaper car insurance cheapest car

car insurance cheaper car insurance cheapest carLoss of usage and devaluation fees are generally not covered by your automobile policy or any type of insurance coverage your charge card firm might give. Base linefind out just how much protection you carry your very own before you go the rental automobile counter – credit. When the rental auto agent asks if you want to purchase their insurance policy, figure out what their insurance deductible is and also just how much protection their state-required obligation provides. insurance.

Does my individual car insurance cover rental autos? It's going to differ depending upon the personal automobile insurance plan you have and why you've leased an auto – insurance affordable. Occasionally some insurance coverages will encompass a rental. Be certain to inspect what your deductible is on your personal car insurance coverage plan.

Rental vehicle insurance can be truly, truly puzzling. We just recently checked out the tale of one confused vacationer who leased a car in Brussels and also obtained an $810 costs for damaging a bumper. That's since the rental vehicle company pushed them into purchasing additional insurance (with a 600-euro insurance deductible), which revoked the insurance coverage they currently had! That's simply not reasonable.

vans insurance affordable accident vehicle

vans insurance affordable accident vehicleIt's an uncomplicated, easy rental car crash damage waiver that sets you back simply $11 per schedule day as well as covers your rental car practically anywhere in the globe. cheap. What exactly does this kind of rental auto insurance coverage cover?

-

What Is A Total Loss? – Caa South Central Ontario Things To Know Before You Buy

If your auto is amounted to, your insurer will reduce you a check for $15,000. You owe the lender $2,500, as well as you no much longer have an auto.

cheaper car insurance insure insurance company vans

cheaper car insurance insure insurance company vansWhat does insurance pay when a vehicle is completed? Exactly how and just how much your insurance policy pays for an amounted to vehicle depends on a couple of aspects, consisting of the business and the state you call house.

If you can, access the very least one price quote from a trustworthy body store in your location. Contrast it to the insurance provider's record. Employ an appraiser If you believe your insurance provider is means off the mark with their payment, think of employing an evaluator. This should be a last-ditch effort, however, as appraisers aren't cost-free.

All material and services given on or with this website are given "as is" and "as readily available" for use. Quote, Wizard (laws). com LLC makes no depictions or guarantees of any kind of kind, express or suggested, regarding the procedure of this site or to the info, web content, materials, or products consisted of on this site.

vans car insured laws vehicle

vans car insured laws vehicleHispanolistic, Getty Images If you remain in a cars and truck accident, your insurance company may make a decision to create off your automobile as a failure if it fulfills the insurance overall loss auto value. This is the amount of repair work price at which they will certainly complete your vehicle as well as pay for a substitute.

If you are in an auto crash as well as your automobile requires costly fixings, your insurance coverage firm may consider your lorry an overall loss. This implies that it is amounted to and also, depending upon your policy, they will certainly change it for you. The insurer normally determines this quantity by computing the worth of your lorry and also contrasting it to the cost of repairing it. affordable.

Some Ideas on Frequently Asked Questions About Auto Insurance Claims You Need To Know

Rather, it generally varies from state to state, as well as even supplier to carrier. Many car insurance provider utilize a portion of the money value of the vehicle when determining when a total loss value takes place. This is typically an established percentage, meaning if the repair services will certainly cost as much as a specific percent of the complete worth of the car, they will certainly mark it as an overall loss.

Some states have actually a set portion the insurance company should consider a failure worth. The real money value describes the worth of the vehicle prior to the mishap. Insurer calculate this number differently also. They each have their very own software application to make estimations – auto. While you may not have accessibility to your insurer's software application, there are various other techniques you can utilize to identify if your automobile is likely a failure.

However, bear in mind, this is generally an array, and also lots of factors impact cost, consisting of the condition of the car and your place. How Does the Insurance Provider Deal With Repairs? When insurer pay for fixings, they normally accumulate bids from different technicians (credit score). They might select the most affordable one to prevent over-paying, but you do have an option in where you choose repair services.

You have the choice to discuss with the adjuster if you don't believe they are providing you with enough compensation to make the necessary fixings appropriately. Whether your insurance provider covers repair services, as well as just how much, will certainly depend on your policy. auto. Some drivers minimize their insurance coverage for older cars, which might suggest they do not cover repairs at all.

It can be hard to put a worth on a vehicle that is currently harmed, yet insurance coverage companies consist of the list below variables: Year, Make, Model, Gas Mileage, Deterioration, The adjuster will contrast the problem and worth of the lorry before the crash to the expense of fixings, determining if it deserves it to make them or otherwise. credit.

The insurance adjuster determines if the vehicle can be fixed for much less than the insurance coverage's failure car value. The insurance adjuster conducts an assessment, identifying the value of the car before the mishap. The insurer orders an evaluation from a third-party firm as well as compares the two. According to , you don't always have to consent to a failure.

4 Simple Techniques For How To Get The Retail Value For A Totaled Car – It Still Runs

You will most likely demand to submit proof specifying why your car is worth greater than they assert and you have a right to employ your own appraiser if you don't agree with the appraised value. If you concur with the failure, after that you must eliminate your plates, personal belongings, as well as complete the insurance coverage documents (laws).

Otherwise, your car is sent to auction. It is necessary to submit your claim asap, especially if you require a lorry to get to work. The cases process can take a while to be refined and you can speed it up by informing the insurance provider and also replying to any arrangements as soon as possible.

That depends upon whether the automobile is had, funded, or leased., we'll pay you straight to a finance business that's provided on your policy or your title: We'll pay the money firm initially If the negotiation quantity is even more than what you owe the financing business, you'll receive the rest (if you're the titled owner) If the negotiation amount is less than what you owe, you'll be liable for paying the equilibrium of your lending *, we'll pay the lease company straight * If you have, it may cover the equilibrium of your finance (vehicle).

Is it worth it? The clear solution is NOyour automobile is currently a total loss. insure.

cheaper car insurance car insured auto insurance cheaper car

cheaper car insurance car insured auto insurance cheaper carWhen you've had actually the check done, it 'd be less complicated to figure out the totaled cars and truck value. Many times, your car stands a higher opportunity of being amounted to if it's an older version. This is due to the fact that older car models have a tendency to have lower worths of resale. If the damage done to an older vehicle is extreme, it's most likely to have the cost of replacing the broken components go beyond the car's worth.

This is why you'll find a great deal of individuals resistant to have their totaled cars fixed and also would rather have it marketed, possibly as a research study for an automobile course. Below's How to Compute the Value of a Totaled Auto. You may not wish to just approve your firm's deal for your amounted to auto as well as intend to do the computations on your own to understand the Actual Cash Worth [ACV] of your auto – cheaper cars.

The Only Guide for What Happens When Your Car Is Totaled? – Usaa

accident risks perks car insurance

accident risks perks car insuranceTo discover the real value of your automobile, you can examine credible rates websites – business insurance. Note the condition of your cars and truck before the accident occurred, the current mileage and any kind of various other aftermarket parts that you installed as these typically include to a car's worth. Make certain you have the invoices for such accessories when having your settlements.

The insurer might not have recognized the included accessories to your vehicle and will only consider your claim if he sees acceptable paperwork. You may not require to show any documents if the preliminary payment amount offered by your insurance coverage company decreases well with you. Enable Cars And Truck Rental Repayment.

This expense ought to be covered by your insurer as it's straight related to the mishap that got your cars and truck completed. Discover out if your insurance policy business prefers to pay this amount individually or together with your completed car payment. Calculate All the Needed Charges. prices. Determine all taxes, enrollment and also title costs on your auto.

Doing this will assist you validate if the vehicles were offered for the prices you calculated. We would certainly advise you to get about three or more estimates.

Just how much your insurance coverage will cover for your totaled vehicle is consisted of in their plan's small print. For you to get the maximum payout for your totaled vehicle, you require to understand just how your insurance business will certainly compute the amount as well as the alternatives that are open to you. Replacement Pay-out.

The last result needs to suffice to have your vehicle replaced with a comparable one prior to it obtained amounted to. After your insurance firm has identified the reasonable market worth for your auto, sales tax, registration fees, receipts of the amount for added accessories as well as other prices related to your area will be included [as we've previously stated]

All about What Is Total Loss After A Car Insurance Claim? – Valuepenguin

It's a little bit challenging to place a certain quantity on your amounted to car yet your insurer will have its technique for computing your automobile's ACV. To identify the ACV as well as amounted to worth of your auto, your insurer will use your car's year, make, model, gas mileage, as well as damage done to calculate their results (trucks).

If your automobile is old and also badly harmed, your insurance policy company is likely to write it off and not bother repairing it as it will not deserve it (cheaper cars). Your insurance provider calculates the price they can pay based off of previous auction information and the expenses of eliminating the automobile.

Allow's utilize our previous instance of a completed cars and truck with an ACV of $10,000. 10 percent of this value would certainly be $1,000. This suggests that $1,000 and your deductibles would certainly be deducted from the ACV of your vehicle to end up with the quantity that you'll be paidif you desire to maintain your completed automobile (suvs).

If you have actually obtained a car loan hanging over your automobile, you would certainly need to clear it before getting a brand-new vehicle. You may be fortunate as well as the payout from your insurance policy business on your amounted to vehicle will be more than the financing balance.

However, if the financing balance goes beyond the payment from your insurance coverage firm, then the entire payment will certainly be made use of to remove the funding. You would certainly after that need to compose the difference left. affordable car insurance. A GAP (Guaranteed Vehicle Defense) insurance can save you if you bought one after taking the funding on your auto.

Just how to Utilize Our Online Totaled Cars And Truck Value Calculator to Establish the Rate of Your Totaled Automobile. If you're searching for a perfect way to get a good estimate for your totaled car then you're better off with our online amounted to auto value calculator. You'll obtain an assured quote in a minute.

Rumored Buzz on Totaled Vehicle : After An Accident

At Offer, Max, you're not pressured to offer your totaled cars and truck once you get a deal from usthe sphere is always in your court. You're always welcome to use our online completed car worth calculator to Additional reading recognize what your amounted to car is worth. You'll obtain a reasonable offer from us for your auto, regardless of the state it remains in.

Devaluation starts once you purchase the auto. A brand-new automobile you recently bought is much less valuable than a similar make as well as model still resting at the car dealership.

It's true that it can lose considerable worth in the first year. Certainly, a vehicle's value usually drops dramatically if it's entailed in a significant crash. If there's a great deal of damage, the insurance coverage company may call it a failure. This takes place when the repair work are approximated to cost greater than the automobile's insurance coverage worth.

-

The Best Guide To Average Us Car Insurance Costs By State For 2022 – Kelley …

vans insurance cheap car dui

vans insurance cheap car dui prices accident trucks vans

prices accident trucks vansResponse: (A) An insurance firm might refund a fee if a single lorry plan is rescinded without having actually come to be reliable. (B) An insurance provider might reimburse a charge if a vehicle included in a multi-vehicle plan is ultimately eliminated prior to the protection for that car becomes efficient despite the fact that the policy itself stays effective.

An insurer should reveal the cost as a separately recognized amount on a premium bill, the declarations page of the plan, or in a different created communication to the insurance holder (insurance affordable). Answer: An insurance provider needs to maintain its documents in such a fashion that quantities created and also accumulated from each insurance holder can be recognized.

Solution: No, the cost is exempt to exceptional tax. Answer: All questions ought to be emailed to: [e-mail shielded].

Brooklynites have the highest possible cars and truck insurance coverage prices in all of New York State, according to a brand-new research study (low cost auto). Image via Pexels With new studies revealing that auto insurance prices are at an all-time high in the U.S., Brooklynites have added reason to grumble their prices are the greatest in New york city state, where car insurance prices have risen, over the in 2015, 62.

Contrast this with the insurance coverage prices chauffeurs pay in various other parts of New york city state, such as Dutchess County, where the average cost is roughly $1,600 a year. Brooklyn is house to greater than 2. low cost auto. 6 million citizens, making it one of the most inhabited district in the city. About a third of Brooklyn's functioning populace commutes to function, a possible factor adding to the borough's higher costs.

The Of How To Figure Out The Cost Of Car Insurance Per Month – Jerry

According to the Zebra, there are 1. 4 million vehicle drivers in New york city City (cheap insurance). Relevant Articles.

The ordinary New York house owners insurance coverage price is $1,309 annually, can be found in simply a little much more expensive than the nationwide variety of $1,211 annually. If you're looking for the lowest rate on home insurance coverage, think about getting quotes with a qualified professional.

In this article, Part 1 goes over the significance of understanding your monthly fee, Part 2 shows you how to calculate monthly costs, as well as Part 3 discusses exactly how to contrast the results. Part 1 of 3: The importance of knowing your regular monthly costs, There are a few reasons you might wish to know what your regular monthly insurance policy expense would be. cheapest auto insurance.

If you pay each year as well as have no installment or various other fees, you separate your yearly costs by 12 – auto. To determine what your month-to-month prices would be with our instance premium, you can utilize this formula: ($1,200-$100)/ 12 = $91. 66. (Annual premium-discount)/ year = monthly price, Your month-to-month automobile insurance policy price, if paying in complete ahead of time, would certainly be $91.

According to our research study, the national typical representative automobile insurance price is $1,442 per year. That amount is based on information from 9 of the biggest car insurance coverage firms in the nation. We did a detailed analysis of automobile insurance policy prices for motorists across the country to find the cheapest insurance firms in each state.

Also within the very same state, you may find that rates change in different ZIP codes. cheap.

In New York, there are over 12 million vehicle drivers, which is why its roads are the busiest in the U (cheaper car).S.And with this numerous drivers when traveling, there's more possibility for a motorist to obtain right into a mishap. If you do drive and possess an auto, you need automobile insurance policy not simply for your defense yet likewise because it's mandated by New York state regulation.

And for complete coverage, some drivers can't afford it – cheap insurance. So just how do you discover the most effective auto insurance in New york city that fits your needs and is reasonably inexpensive? According to a Home, Nest research, the average expense of a common car insurance coverage in New York state is $2,115 a year.

The price quotes serve in learning what the typical individual with the average cars and truck might get priced quote. Nevertheless, you should shop for your own quotes for individualized insurance coverage as well as costs. Results may vary according to various metrics such as your driving background, credit rating, auto model, and also security functions to call a couple of.

The Single Strategy To Use For How Much Is A Car Insurance In New York Per Year? – Quora

affordable dui auto insurance vehicle insurance

affordable dui auto insurance vehicle insuranceAll you require to do is download an app on your smart device and also it will certainly start to track your driving habits. If you drive safely, the app then calculates a cash incentive – credit. Furthermore, you can earn incentive points when you prevent tough stopping, keep the speed restriction, and also more driving-related routines.

Scores, J.D. Power: Rated fourteenth out of twenty-four auto insurer for customer fulfillment, In terms of total client service, J.D. Power rated the business above standard in a survey, AM Ideal Rate: ALiberty Mutual Vehicle Insurance Policy Pros & Disadvantages, Pros, Disadvantages, Plenty of attributes, In a J.D. Power car insurance coverage research study, the firm is a little low-grade in consumer complete satisfaction, If you pay $30 every year to an insurance deductible fund, your insurance deductible will be minimized by $100Limited availability of discount rates, Online tools are simple to utilize, Greater than typical problems, Teachers can obtain free automobile insurance policy such as collision and personal effects insurance policy, Geico: Finest Vehicle Insurance Coverage with the Many Discount rates, Editor's Ranking (5 Stars out of 5)Geico supplies inexpensive complete coverage cars and truck insurance in New York.

5 Stars out of 5)We understand you enjoy driving your CLK GTR Roadster, one of the most restricted production that Mercedes-Benz ever before built – cheaper. The majority of times your Roadster is safely kept in your garage, and if you have State Ranch Collector as well as Vintage Car Insurance, that's exactly where the business intends to keep your car.

We picked State Ranch for vintage cars because the insurance provider supplies fairly affordable prices and also coverage choices for timeless automobiles. Pricing is based on usage. If you just take your vehicle for a spin from time to time, the prices based on use will give you a really enticing discount.

Power: 4. 2/5NAIC: 1. 44BBB: A+S&P: AAMoody's: AState Ranch Car Insurance Pros & Disadvantages, Pros, Disadvantages, Insurance coverage available nationwide, Restricted special discount rates for classic automobiles, Fees based on use, NAIC ranking is 1. 44, which indicates the insurance has received more problems than the ordinary car insurance coverage company, Rates approach other timeless and also antique vehicle insurance coverages, Travelers Insurance: Finest Car Insurance Policy with Optional Functions That Issue, Editor's Score (4 Stars out of 5)Travelers common automobile insurance has high marks for consumer complete satisfaction as well as cost.

All About Commercial Auto Insurance Cost – Insureon

The optional Costs New Cars and truck Replacement is a top-notch add-on. Primarily, if you have a mishap and your cars and truck is totaled in the very first 5 years you possess it, Travelers will provide you a brand-new version of the same make.

AM Finest, which ranks the economic strength of insurance coverage suppliers to figure out if they can meet their clients' requirements, provided Travelers the greatest ranking of A++. J – cheapest car insurance.D. Power asserts that the customer satisfaction ranking is 823 out of 1,000 when the ordinary car insurance policy is 835. This suggests the firm's credibility is a little listed below in contrast to other insurance firms.

That's not what you want to listen to when you buy a car policy from Progressive. 33 rating, which suggests the company has a higher-than-average client problem rate.

Progressive Auto Insurance Policy Pros & Disadvantages, Pros, Disadvantages, For those searching for a big, reputable provider, Ordinary client service ratings, Several methods to obtain a first quote, Discount rates as well as protection options can differ in various states, Excellent financial stamina rankings, Extra costly than similar competitors, Amica: Best Automobile Insurance Coverage with a Basic Policy That Has Attractive Built-In Rewards, Editor's Rating (4 Stars out of 5)Amica has the very best customer fulfillment rankings as well as less consumer grievances than anticipated when compared to other costs that are of the same size (cheaper cars).

JD Power rating: "over ordinary total."A – credit.M. Finest: A++Standard as well as Poor: AANAIC: Excellent, which suggests Chubb obtained far less complaints than average. Chubb Vehicle Insurance Policy Pros & Disadvantages, Pros, Disadvantages, Helpful for high-net-worth consumers wanting to cover expensive cars and trucks, Much too costly rates, Some negotiations can be wrapped up on the same day, Costly add-ons increase the prices, Lock and crucial replacement coverage with no deductible, Doesn't concentrate on providing economical insurance policy, Not good for consumers trying to find the least expensive rates, In maintaining with their affluent insurance policy holders, Chubb has little to no price cuts besides bundling, No online option to get a quote, Nationwide: Best Auto Insurance Coverage with Online Existence as well as Intuitive App, Editor's Ranking (4 Stars out of 5)Nationwide is all about simpleness.

What's The Average Cost Of Car Insurance In 2020? – Business … – An Overview

Furthermore, there's a different Nationwide application that you can make use of to track your driving, such as not speeding up, and after that the business will certainly use you discounts for risk-free driving. Online, Nationwide's web site includes a portal where you can likewise pay an expense, manage your plans, and file and track insurance claims.

Rates, We got prices for each business based upon characteristics of the average adult vehicle driver in New york city State looking for criterion insurance coverage in significant city as well as rural areas. Our findings show that pricing can vary substantially from company to business. Some insurance policy service providers supply a little bit much more in their basic protection or offer even more discount rates, which add to value variation.

We took a look at how the rates compare to the rest of the New York state and major cities such as Buffalo, Rochester, Yonkers, Syracuse, as well as Albany. The Ordinary Price of Vehicle Insurance in New York City, The expense of automobile insurance coverage varies depending upon the business, where you live (whether it's country or urban), and driving record.

Climate condition like serious storms, wintertime tornados, floodings, and also hefty snow project in New york city as well as can cause increased vehicle insurance rates. Minimal vehicle insurance coverage that's needed by legislation in New York State may not be adequate enough to protect you against an accident (cheaper auto insurance). It's certainly far better for New Yorkers to get insurance coverage except minimal insurance coverage but instead for full coverage.

Because there are a great deal of car insurances that cover New york city, your best option is to find the right business for you by contrasting quotes from various insurance companies. By doing this you can obtain the right protections that are important to you and also for the appropriate cost. Not having sufficient insurance policy means that you might need to pay out-of-pocket in case of a mishap or injury.

Excitement About Commercial Auto Insurance Cost – Insureon

cheapest car business insurance cheapest car insurance company

cheapest car business insurance cheapest car insurance companyYou will have more monetary defense as an outcome, and which is why most auto insurance firms advise higher restrictions. Minimum protection does not include detailed or crash insurance coverages, which pay for damage to your cars and truck.

It makes good sense to shell out for added insurance coverage over minimal requirements if you have valuable assets to protect, such as a limited-edition car. If your responsibility protection is insufficient when an insurance claim is made against you, the various other or damaged motorist can take you to court for financial damages that you will need to Check over here suck up as well as pay (cheaper car insurance).

Residential property damage liability (PD) covers repairs that you trigger to somebody else's auto or property. Basically, it's something physical you wreck that does not come from you, such as the front of a house or a building, Comprehensive and also Collision Insurance Coverage, Comprehension and collision coverage are typically packed together as well as have the exact same protection restrictions.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.